WI CV-422 2016-2024 free printable template

Show details

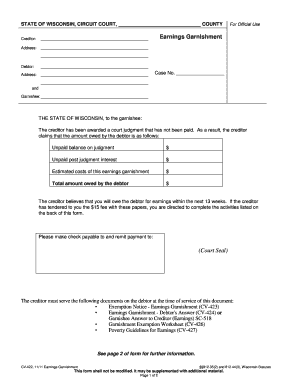

STATE OF WISCONSIN, CIRCUIT COURT, COUNTYCreditor:

Address:Earnings GarnishmentDebtor:Case No. Address:and

Garnishee:THE STATE OF WISCONSIN, to the garnishee:

The creditor has been awarded a court

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your wisconsin earnings 2016-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin earnings 2016-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wisconsin earnings online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wisconsin cv form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

WI CV-422 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wisconsin earnings 2016-2024 form

How to fill out Wisconsin earnings?

01

Determine which tax form to use for reporting Wisconsin earnings. Depending on your filing status and income level, you may need to use Form 1, Form 1NPR, or Form 1X.

02

Gather all necessary documentation and information required for completing the form. This may include your W-2 forms, 1099 forms, receipts for deductions, and any other relevant documents.

03

Start by entering your personal information on the form, including your name, address, social security number, and filing status. Make sure to double-check your information for accuracy.

04

Report your Wisconsin income by carefully following the instructions provided on the form. Include all sources of income, such as wages, self-employment income, rental income, and any other taxable earnings. Be sure to include any income adjustments or deductions you may be eligible for.

05

Calculate your Wisconsin tax liability using the appropriate tax tables or tax rate schedules provided by the Wisconsin Department of Revenue. These tables will help you determine the amount of tax you owe based on your taxable income.

06

After calculating your tax liability, subtract any tax credits you qualify for. Wisconsin offers various tax credits, such as the Earned Income Credit, Child and Dependent Care Credit, and Homestead Credit. Be sure to carefully review the eligibility requirements for each credit and accurately report the amount you are claiming.

07

If you are owed a refund, indicate your preferred method of receiving it (e.g., direct deposit or paper check) and provide the necessary information.

08

Double-check all your entries, calculations, and supporting documents before signing and dating the form. Incomplete or incorrect information may lead to delays in processing or potential penalties.

Who needs Wisconsin earnings?

01

Wisconsin earnings are relevant for individuals who reside in Wisconsin and have earned income within the state. This includes employees, self-employed individuals, and those with various sources of taxable income in Wisconsin.

02

Non-residents who earned income in Wisconsin may also need to report their Wisconsin earnings, depending on the tax laws and regulations of their home state.

03

Additionally, individuals who receive income from Wisconsin sources, such as rental properties or investments, may need to report their earnings and pay taxes accordingly. It is advised to consult with a tax professional or refer to the Wisconsin Department of Revenue's guidelines to determine if you need to report your Wisconsin earnings.

Fill cv 422 garnishment : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wisconsin earnings?

Wisconsin earnings refer to the income or earnings generated by individuals, businesses, or the overall economy in the state of Wisconsin, United States. This includes wages, salaries, profits, dividends, rents, and other sources of revenue earned within the state. Wisconsin earnings play a significant role in measuring the economic health and prosperity of the state.

Who is required to file wisconsin earnings?

Individuals who are residents of Wisconsin and have income from various sources, such as wages, self-employment, rental income, or business profits, are generally required to file Wisconsin state income tax returns. Additionally, non-residents of Wisconsin who have income from Wisconsin sources may also be required to file state tax returns in Wisconsin. However, each individual's tax situation is unique, so it is always recommended to consult with a tax professional or refer to the Wisconsin Department of Revenue for specific filing requirements based on your circumstances.

What is the purpose of wisconsin earnings?

The purpose of Wisconsin earnings is to track and report the income earned by individuals and businesses in the state of Wisconsin. It serves as a recordkeeping and tax collection system used by the state government to ensure accurate reporting and collection of taxes. Wisconsin earnings data helps in determining the tax liability of individuals and businesses, as well as assessing the overall economic activity and financial health of the state. It is also used for statistical analysis, economic planning, and budgeting purposes by the government and other organizations.

What information must be reported on wisconsin earnings?

The information that must be reported on Wisconsin earnings includes the following:

1. Gross wages or earnings: This refers to the total amount of money earned by an employee before any deductions such as taxes, insurance, or retirement contributions.

2. Federal tax withholding: The amount of federal income tax withheld from an employee's earnings as per their W-4 form.

3. State tax withholding: The amount of Wisconsin state income tax withheld from an employee's earnings.

4. Social Security and Medicare taxes: The employee's share of Social Security and Medicare taxes, commonly known as FICA taxes, which are deducted at a fixed rate from their earnings.

5. Other deductions: This includes any other deductions authorized by the employee, such as health insurance premiums, retirement contributions, or union dues.

6. Net pay: This is the remaining amount of money that an employee receives after all deductions have been made from their gross wages.

In addition to these earnings-related details, other information reported on Wisconsin earnings may include the employee's name, address, Social Security number, pay period dates, hours worked, and any overtime or bonuses received.

What is the penalty for the late filing of wisconsin earnings?

In Wisconsin, if you fail to file your income tax return or file it late, you may be subject to penalties. The penalties for late filing of Wisconsin earnings include the following:

1. Late filing penalty: If you filed after the due date but within 30 days, the penalty is 5% of the unpaid tax or $20, whichever is greater. If you filed after 30 days, the penalty increases to 10% of the unpaid tax or $100, whichever is greater.

2. Late payment penalty: If you filed your return on time but did not pay the full amount owed, you may be subject to a late payment penalty. This penalty is 0.5% of the unpaid tax for each month the tax remains unpaid, up to a maximum of 12%.

3. Interest charges: Interest is also charged on unpaid tax from the original due date until the tax is paid in full. The interest rate is determined annually.

It's important to note that penalties and interest may vary depending on individual circumstances, so it is advisable to consult the Wisconsin Department of Revenue or a tax professional for specific details related to your situation.

How to fill out wisconsin earnings?

To fill out Wisconsin earnings, you can follow these steps:

1. Obtain the necessary forms: You will need Form WI-Z (if you are an individual filing a resident return) or Form 1 (if you are a nonresident or part-year resident). These forms can be found on the Wisconsin Department of Revenue website.

2. Provide your personal information: Fill in your full name, mailing address, Social Security number, and date of birth in the designated fields.

3. Report your income: Enter your total income for the filing period, including wages, salaries, tips, self-employment income, rental income, dividends, interest, etc. Provide the required information for each income source.

4. Deductions and adjustments: You may be eligible for certain deductions and adjustments, such as student loan interest, educator expenses, etc. Fill out the appropriate sections on the form to claim these deductions.

5. Calculate tax liability: Based on your income and deductions, calculate your Wisconsin tax liability using the provided tax tables or the tax calculation worksheet on the form.

6. Credits and payments: Determine if you qualify for any tax credits, such as the Earned Income Tax Credit or the Child and Dependent Care Credit. Additionally, report any taxes withheld from your income in the payments section.

7. Sign and date the form: Ensure you sign and date your Wisconsin earnings form before submitting it. If filing jointly, both spouses must sign.

8. Submit the form: Mail the completed form to the Wisconsin Department of Revenue address provided on the form. Alternatively, you can e-file your return using approved software or through the Wisconsin Department of Revenue's website.

It is recommended to review the official instructions and consult with a tax professional if you have any specific questions or complex tax situations.

How can I send wisconsin earnings to be eSigned by others?

Once your wisconsin cv form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute cv 422 online?

pdfFiller has made filling out and eSigning cv422 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit how to wisconsin cv in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing wisconsin earnings printable form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Fill out your wisconsin earnings 2016-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cv 422 is not the form you're looking for?Search for another form here.

Keywords relevant to cv 422 printable form

Related to cv garnishment

If you believe that this page should be taken down, please follow our DMCA take down process

here

.